Fcf margin formula

Free cash flow FCF is a measure of a companys financial performance calculated as operating cash flow minus capital expenditures. Cash flow is the net amount of cash and cash-equivalents moving into and out of a business.

Free Cash Flow Conversion Formula And Excel Calculator

For asset-heavy companies and reflects one of the shortcomings of EBITDA.

. Future 3-5Y EPS without NRI Growth Rate Industry Rank. To fund this transaction the PE firm was able to obtain 40x EBITDA in Term Loan B TLB financing which will come with a seven-year maturity 5 mandatory amortization and priced at LIBOR 400 with a 2 floor. Core FCF orange line is free cash flow minus changes to working capital and stock-based compensation.

Also depending on which Free Cash Flow formula you are using FCFF or FCFE your formula may automatically include the impacts of stock based compensation FCFF or will automatically. Operating Cash Flow Capital Expenditure and Net Working Capital. However using a horizon value formula you can make calculated assumptions on a companys long-term cash flow growth which g oes well beyond 10 years for instance.

Positive cash flow indicates that a companys liquid assets are increasing enabling it to settle debts. The target number of days for the CCC differs substantially by the industry the company operates within and the nature of productsservices sold eg purchase frequency order volume seasonality cyclicality. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Get 247 customer support help when you place a homework help service order with us. Higher Gross Margin yoy Higher Asset Turnover yoy Intel Corp Filings. It is the percentage of a companys income it pays in taxes.

The formula for calculating EBITDA at its simplest. EBITDA net income interest taxes depreciation amortization A companys income statement cash flow statement and balance sheet all provide. Levered free cash flow is the amount of cash a company has left remaining after paying all its financial obligations.

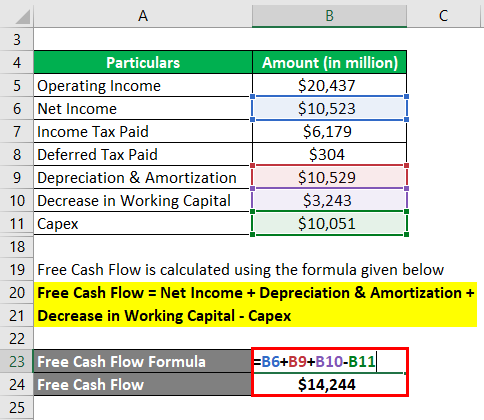

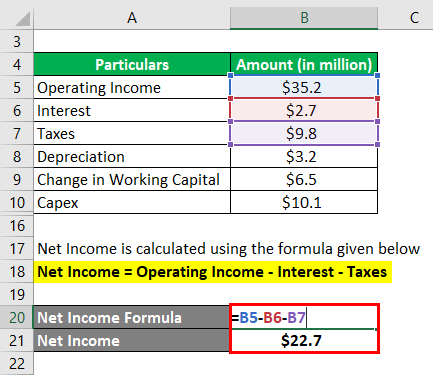

All-In-One Screener Ben Graham Lost Formula Canadian Faster Growers CEO Buys CEO Buys after Price Drop 20 Dividend Aristocrats 2022 Dividend Growth Portfolio Dividend Income. You can easily calculate the Free Cash Flow using the Formula in the template provided. SP 500 Average Valuation Multiples by Industry.

The formula to calculate terminal value looks like this. 3-Year FCF Growth Rate -189. As per the FCF formula FCF Operating Income Capital Expenditure Rs14026300 36749700-25653000 1848100 17559900 Rs14026300 37657800 Rs-30504700 As per the outcome of the free cash flow calculation it can be seen that the capital expenditure is more than the available free cash flow.

In the calculation of the weighted average cost of capital WACC the formula uses the after-tax cost of debt. The fixed asset turnover ratio formula measures the companys ability to generate sales using the fixed assets investments. FCF FCF The cash flow to the firm or equity after paying off all debts and commitments is referred to as free cash flow.

Higher Gross Margin yoy Higher Asset Turnover yoy Alphabet Inc Filings. You can calculate the tax rate from the income statement by dividing the total tax expenses by the companys earnings before taxes. Here is the formula for calculating EBITDA.

Levered free cash flow is important to both investors and company management. It is very easy and simple. Here we discuss formula to calculate Profit Before tax along with examples advantages and disadvantages.

You need to provide the three inputs ie. The company has been booking large non-cash charges due to amortization and depreciation as well as asset write-offs. The fixed asset turnover ratio measures the efficiency of a company and is evaluated as a return on their investment in fixed assets such as.

If acquired the PE firm believes JoeCos revenue can continue to grow 10 YoY while its EBITDA margin remains constant. What is a Leverage Ratio. You can calculate NOPAT by multiplying a companys operating income by 1 minus the corporate tax rate.

Accounting for stock based compensation expense can be tough because the numbers dont always line-up from the income statement to the cash flow statement. Price-to-DCF Earnings Based. All-In-One Screener Ben Graham Lost Formula Canadian Faster Growers CEO Buys CEO Buys after Price Drop 20 Dividend Aristocrats 2022 Dividend Growth Portfolio Dividend Income Portfolio.

Core FCF is around 300. Higher Gross Margin yoy Higher Asset Turnover yoy Starbucks Corp Filings. Free Cash Flow - FCF.

The corporate tax rate is also known as the effective tax rate. Operating Margin Operating Income Revenue. It is calculated by dividing the net sales by the average fixed assets.

The reason why the pre-tax cost of debt must be tax-affected is due to the fact that interest is tax-deductible which effectively creates a tax shield ie. EBITDA can be divided by revenue in the corresponding period to arrive at the EBITDA margin which is a standard measure of profitability used across a broad range of industries. This post displays the mostly commonly used valuation.

All-In-One Screener Ben Graham Lost Formula Canadian Faster Growers CEO Buys CEO Buys after Price Drop 20 Dividend Aristocrats 2022 Dividend Growth Portfolio Dividend Income. FCF can be substantial ie. A Leverage Ratio measures a companys inherent financial risk by quantifying the reliance on debt to fund operations and asset purchases whether it be via debt or equity capital.

PE PFCF PS PB PEG There are many valuation multiples which investors use to compare stocks with their peers in an industry. The operating cash flow can be found on the. Operating Cash Flow Margin.

Typically the debt incurred by the company is compared to metrics related to cash flow assets and total capitalization which collectively help gauge the companys credit risk. Increased 390 basis points YoY Record earnings per share of 137. The key numbers to focus on at present are the operating cash flow free cash flow and ore FCF.

Increased 384 YoY Reduced net debt by. The interest expense reduces the taxable income earnings. Record Fiscal 1st Quarter 2023 Results non-GAAP 7 Record revenue of 1964 billion.

It is measured using specific ratios such as gross profit margin EBITDA and net profit margin. Free Cash Flow Formula in Excel With excel template Here we will do the example of the Free Cash Flow Formula in Excel. 1 Answer to To return the value of the cell D8 the formula should be OFFSETA1 2 To set up scenarios you need to first use to set up a list then to set up the reference cell.

Increased 230 basis points YoY Record operating margin of 456. FCF represents the cash that a company. Price-to-DCF Earnings Based 035.

The operating margin formula is the following. 4 C H A 1 of periods 3 20171231 20181231 20191231 20201231 20211231 20221231 20231231 20241231 4 FCF 300 400 500 600 700 800 900 -1000. However for the most part the lower the CCC the more beneficial it is for the company as it implies that less time is needed to convert working capital into cash on hand.

Grew 65 QoQ and 251 YoY 7 consecutive quarters of record revenue Record gross margin of 671. This indicates that in a. The best way to calculate the perpetuity value is to make use of the Gordon Growth Model.

An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales.

Profit Margin Formula And Ratio Calculator

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Cash Flow Formula How To Calculate Cash Flow With Examples

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Formula Formula For Free Cash Flow Examples And Guide

Free Cash Flow To Equity Fcfe Formula And Excel Calculator

Cash Flow Formula How To Calculate Cash Flow With Examples

Unlevered Free Cash Flow Definition Examples Formula

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Financial Ratios And Formulas For Analysis Financial Ratio Financial Analysis Financial Accounting

Free Cash Flow Yield Formula And Calculator

Free Cash Flow Conversion Formula And Excel Calculator

Free Cash Flow To Firm Fcff Formulas Definition Example

Free Cash Flow Formula Calculator Excel Template

Free Cash Flow To Firm Fcff Formula And Excel Calculator